Documento Relacionado

Vancouver, B.C., October 15, 2018 – Panoro Minerals Ltd. (TSXV: PML, Lima: PML, Frankfurt: PZM) (“Panoro”, the “Company”) is pleased to announce the commencement of detailed 3D Geophysical survey at Zone 1 of the Chaupec Target.The objective of the survey is to finalize drill targets for the proposed exploration program.The Chaupec Target contains Skarn and Porphyry type mineralization located within Cluster 2 at the 100% owned Cotabambas Copper Project.

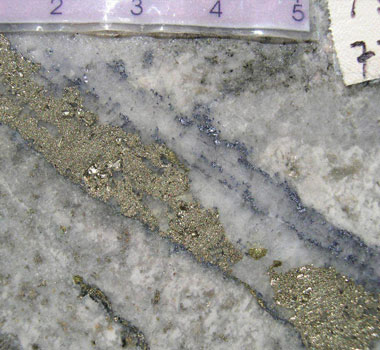

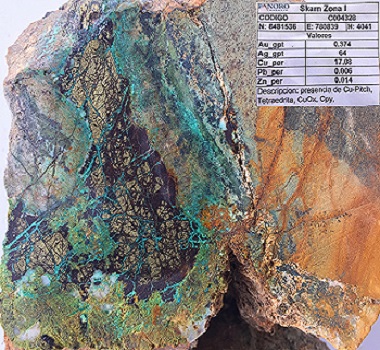

The survey will be completed at the northern area of Zone 1, where Sills of quartz monzonite composition intrude wide altered bodies of limestones and skarn composed by piroxenes, garnets, magnetite, chlorite and epidot. The associated mineralization is composed of copper oxides, chalcopyrite, chalcocite, and bornite sulphides outcropping at surface. The package of sills/skarn is exposed along an area of approximately 450 m by 600 m along the contact of the Diorite over thrusting the limestones of the Ferrobamba formation.Details of the Chaupec Target can been found on Panoro press release of August 28th, 2018.

The survey grid is shown on the attached map together with the surficial geology. The Geophysics field work will include IP, Magnetometry and gravity, as summarized below:

- 3D Ground Magnetometry including 20 lines of 1 km length each, at 25 m spacing.

- Previous Ground Magnetometry was completed in the area at spacing of between 100 m and 200 m with readings each 10 m to 20 m.These surveys served to infer limits of the main packages of limestones, diorite and sills/skarn. The current survey will include continuous readings along the lines and will be concentered on the sill/skarn package.

- Previous Ground Magnetometry was completed in the area at spacing of between 100 m and 200 m with readings each 10 m to 20 m.These surveys served to infer limits of the main packages of limestones, diorite and sills/skarn. The current survey will include continuous readings along the lines and will be concentered on the sill/skarn package.

- IP-3D including 10 lines of 1 km length, spacing of 50 m between lines and with stations of 25, 50, 75 & 100 meters multi-dipole.

- Previous IP surveys in the area were completed with 100 m spacing and readings each 50 m. The survey will permit identification of charged and resistive bodies with a resolution of 25 m and to approximately 300 m depth.

- Previous IP surveys in the area were completed with 100 m spacing and readings each 50 m. The survey will permit identification of charged and resistive bodies with a resolution of 25 m and to approximately 300 m depth.

- Gravity survey, including 110 points distributed over the same grid as for the Magetometry and IP.

The goal of the survey is to identify structural controls, directions and thicknesses of the Skarn bodies which reported high copper, silver and gold anomalies on the surface rock sampling. The survey will be complemented with additional detailed mapping to finalize the location, orientation and depth of proposed drill holes of the exploration program.

About Panoro

Panoro Minerals is a uniquely positioned Peru focused copper exploration and development company. The Company is advancing its two advanced stage copper projects;

- Cotabambas Copper-Gold-Silver Project; and

- Antilla Copper-Molybdenum Project.

The Company also has two early stage projects being funded and/or advanced with partners;

- Kusiorcco Copper Project, funded by Hudbay Minerals; and

- Humamantata Copper Project, funded by JOGMEC.

Panoro’s Projects are located in the strategically important area of southern Peru.The region boasts the recent investment of over US$15 billion into the construction or expansion of four large open pit copper mines (Las Bambas, Constancia, Antapaccay and Cerro Verde) and another $US 3 billion being invested currently into two additional open pit copper mines (Mina Justa and Quelleveco).

Since 2007, the Company has completed over 80,000 meters of exploration drilling at these two key projects leading to substantial increases in the mineral resource base for each, as summarized in the table below.

Summary of Cotabambas and Antilla Project Resources

Project | Resource | Million | Cu (%) | Au (g/t) | Ag (g/t) | Mo (%) |

Cotabambas Cu/Au/Ag | Indicated | 117.1 | 0.42 | 0.23 | 2.74 | 0.001 |

Inferred | 605.3 | 0.31 | 0.17 | 2.33 | 0.002 | |

@ 0.20% CuEq cutoff, effective October 2013, Tetratech | ||||||

Antilla Cu/Mo | Indicated | 291.8 | 0.34 | - | - | 0.01 |

Inferred | 90.5 | 0.26 | - | - | 0.007 | |

@ 0.175% CuEq cutoff, effective May 2016, Tetratech | ||||||

Preliminary Economic Assessments (PEA) have been completed for both the Cotabambas and Antilla Projects, the key results are summarized below.

Summary of Cotabambas and Antilla Project PEA Results

Key Project Parameters | Cotabambas Cu/Au/Ag | Antilla Cu | ||

Process Feed, life of mine | million tonnes | 483.1 | 118.7 | |

Process Feed, daily | Tonnes | 80,000 | 20,000 | |

Strip Ratio, life of mine | 1.25 : 1 | 1.38: 1 | ||

Before Tax1 | NPV7.5% | million USD | 1,053 | 520 |

IRR | % | 20.4 | 34.7 | |

Payback | years | 3.2 | 2.6 | |

After Tax1 | NPV7.5% | million USD | 684 | 305 |

IRR | % | 16.7 | 25.9 | |

Payback | years | 3.6 | 3.0 | |

Annual Average Payable Metals | Cu | thousand tonnes | 70.5 | 21.0 |

Au | thousand ounces | 95.1 | - | |

Ag | thousand ounces | 1,018.4 | - | |

Mo | thousand tonnes | - | - | |

Initial Capital Cost | million USD | 1,530 | 250 | |

1. Project economics estimated at commodity pricesof; Cu = US$3.00/lb, Au = US$1,250/oz, Ag = US$18.50/oz, Mo = US$12/lb. 2. Project economics estimated at long term commodity price of Cu = US$3.05/lb and Short term commodity price of Cu = US$3.20, US$3.15 and US$3.10 for Years 1,2 and 3 of operations, respectively. | ||||

The PEAs are considered preliminary in nature and include Inferred Mineral Resources that are considered too speculative to have the economic considerations applied that would enable classification as Mineral Reserves. There is no certainty that the conclusions within the updated PEA will be realized. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

Luis Vela, a Qualified Person under National Instrument 43-101, has reviewed and approved the scientific and technical information in this press release.

On behalf of the Board of Panoro Minerals Ltd.

Luquman Shaheen. PEng, PE, MBA President & CEO

FOR FURTHER INFORMATION, CONTACT:

Panoro Minerals Ltd.

Luquman Shaheen, President & CEO

Phone: 604.684.4246 Fax: 604.684.4200

Email: info@panoro.com

Web: www.panoro.com

Renmark Financial Communications Inc.

Laura Welsh

Tel.: (416) 644-2020 or (416) 939-3989

welsh@renmarkfinancial.com

www.renmarkfinancial.com

CAUTION REGARDING FORWARD LOOKING STATEMENTS: Information and statements containedin this news release that are not historical facts are “forward-looking information” within the meaning of applicable Canadian securities legislation and involve risks and uncertainties.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ materially from those expressed or implied by the forward-looking statements, including, without limitation:

- risks relating to metal price fluctuations;

- risks relating to estimates of mineral resources, production, capital and operating costs, decommissioning or reclamation expenses, proving to be inaccurate;

- the inherent operational risks associated with mining and mineral exploration, development, mine construction and operating activities, many of which are beyond Panoro’s control;

- risks relating to Panoro’s ability to enforce Panoro’s legal rights under permits or licenses or risk that Panoro’s will become subject to litigation or arbitration that has an adverse outcome;

- risks relating to Panoro’s projects being in Peru, including political, economic and regulatory instability;

- risks relating to the uncertainty of applications to obtain, extend or renew licenses and permits;

- risks relating to potential challenges to Panoro’s right to explore and/or develop its projects;

- risks relating to mineral resource estimates being based on interpretations and assumptions which may result in less mineral production under actual circumstances;

- risks relating to Panoro’s operations being subject to environmental and remediation requirements, which may increase the cost of doing business and restrict Panoro’s operations;

- risks relating to being adversely affected by environmental, safety and regulatory risks, including increased regulatory burdens or delays and changes of law;

- risks relating to inadequate insurance or inability to obtain insurance;

- risks relating to the fact that Panoro’s properties are not yet in commercial production;

- risks relating to fluctuations in foreign currency exchange rates, interest rates and tax rates; and

- risks relating to Panoro’s ability to raise funding to continue its exploration, development and mining activities.

This list is not exhaustive of the factors that may affect the forward-looking information and statements contained in this news release. Should one or more of these risks and uncertainties materialize,or should underlying assumptions prove incorrect, actual results may vary materially from those described in the forward-looking information. The forward-looking information contained in this news release is based on beliefs, expectations and opinions as of the date of this news release. For the reasonsset forth above, readers are cautioned not to place undue reliance on forward-looking information. Panoro does not undertake to update any forward-looking information and statements included herein, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.