Related Document

Vancouver, B.C., August 28, 2018 – Panoro Minerals Ltd. (TSXV: PML, Lima: PML, Frankfurt: PZM) (“Panoro”, the “Company”) is pleased to announce results of the exploration work at Zones 1, 2 and 3 of the Chaupec target. The Chaupec Target is a Cu, Au, Ag Skarn and porphyry target area located at the 100% owned Cotabambas Copper and Gold Project.

Panoro’s mapping and sampling work at the Chaupec Target in 2018 is delineating sixteen anomalies within the three zones of mineralization. The anomalies in Zones 1 and 2 are in Skarn mineralization with grades at surface of up to 1.65% Cu in Zone 1 and up to 0.59% Cu in Zone 2. The anomalies in Zone 3 are within quartz monzonite porphyry (QMP) mineralization with grades of up to 0.67% Cu.

The mineralization at Chaupec has high continuity over an area of 1 km by 3.5 km, elongated in the North-South direction. Panoro has completed detail mapping at 1:1,000 scale, collected and tested 1,626 rock samples, and completed geophysics surveys including 72 km of IP, 85 km of Magnetometry and 67 km of self potential. See map attached here.

“The geologic work being completed at the Chaupec target is further delineating the potential for high grade near-surface mineralization at the Cotabambas Project. This potential presents the opportunity for important enhancements to the project design and economics. In addition, the possible porphyry body underlying the near surface high grade anomalies is further expanding the project growth potential. The expanded area of the EIAsd, recently approved by the Peruvian Ministry of Energy and Mines, includes the Chaupec Target. The company expects to be ready to commence the first drilling at the Chaupec Target as soon as the mapping, sampling and detailed geophysics is completed”, says Luquman Shaheen, President & CEO of Panoro Minerals.

Panoro is preparing a tightly spaced geophysics survey to test the north side of the Zone 1, including 21 km Magnetics, 11km IP-3D and 110 dots gravimetry. The Company is planning a diamond drilling exploration program following the completion of the geophysical surveys. In parallel, the Company is planning to continue with mapping and geochemistry survey around other skarns/porphyry targets in the Cluster 2, such as Jean Louis, Chuyllullo, Cullusayhuas, Rosario and Añarqui.

Chaupec Target Zone One

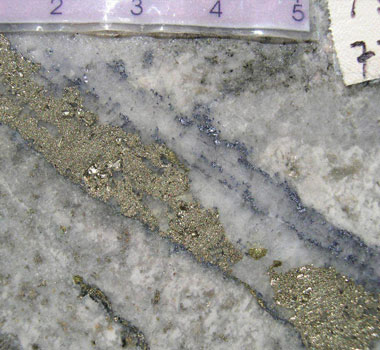

There are two mineralization events in a 600 m by 1,600 m area. The first is related to sills, skarns following the limestone layers in north-south direction, and the second related to irregular bodies/breccias following a east-west structural control. The associated copper mineralization is made up of chalcopyrite, bornite, overprinted by galena, tetrahedrite, and marmatite. The geochemistry survey and mapping identified nine copper anomalies, summarized in the following table. See cross section 1 attached.

| Anomaly # | Large (m) | Width (m) | Samples # | Cu % | Au g/t | Ag g/t | Pb % | Zn % |

|---|---|---|---|---|---|---|---|---|

| 1 | 320 | 90 | 40 | 0.47 | 0.02 | 4.9 | 0.033 | 0.037 |

| 2 | 290 | 90 | 32 | 0.22 | 0.03 | 3.7 | 0.027 | 0.027 |

| 3 | 160 | 75 | 22 | 1.65 | 0.02 | 11 | 0.041 | 0.014 |

| 4 | 900 | 120 | 123 | 1.02 | 0.03 | 6.6 | 0.025 | 0.05 |

| 5 | 430 | 90 | 36 | 1.01 | 0.02 | 3.3 | 0.007 | 0.014 |

| 6 | 400 | 60 | 41 | 0.36 | 0.04 | 5 | 0.074 | 0.161 |

| 7 | 580 | 80 | 95 | 0.37 | 0.06 | 17.7 | 0.071 | 0.138 |

| 8 | 130 | 40 | 15 | 0.15 | 0.01 | 0.8 | 0.003 | 0.012 |

| 9 | 260 | 130 | 37 | 0.27 | 0.04 | 3.2 | 0.036 | 0.182 |

Chaupec Target Zone Two

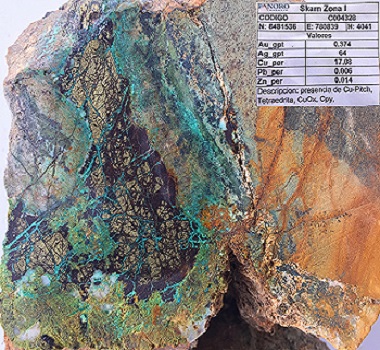

The main mineralization is spread in 600 m by 600 m area containing six skarn bodies including garnet andradite, pyroxenes and magnetite, in contact with small stocks and dikes of QMP composition. Typical minerals are copper oxides, pitch limonite, chalcopyrite and bornite. Four copper anomalies have been delineated as summarized in the table below. See cross section 2 attached.

| Anomaly # | Large (m) | Width (m) | Samples # | %Cu | g/t Au | g/t Ag | %Pb | %Zn |

|---|---|---|---|---|---|---|---|---|

| 1 | 430 | 60 | 68 | 0.44 | 0.14 | 4.6 | 0.004 | 0.013 |

| 2 | 270 | 60 | 18 | 0.21 | 0.03 | 0.8 | 0.002 | 0.008 |

| 3 | 260 | 60 | 11 | 0.59 | 0.02 | 2.5 | 0.012 | 0.035 |

| 4 | 150 | 40 | 4 | 0.58 | 0.03 | 2.8 | 0.004 | 0.013 |

Chaupec Target Zone Three

The mineralization is associated with a QMP outcropping over an area of 400 m by 500 m containing Cu Oxides, malachite, brochantite, chalcopyrite and bornite. The phyllic and argillic alteration overprint/destroys the potassic event. Three copper anomalies have been delineated as summarized in the table below.

| Anomaly # | Large (m) | Width (m) | Samples # | %Cu | g/t Au | g/t Ag | %Pb | %Zn |

|---|---|---|---|---|---|---|---|---|

| 1 | 170 | 30 | 25 | 0.67 | 0.04 | 71.2 | 0.156 | 0.021 |

| 2 | 220 | 20 | 5 | 0.21 | 0.01 | 6.7 | 0.068 | 0.009 |

| 3 | 160 | 30 | 6 | 0.36 | 0.03 | 18.8 | 0.100 | 0.022 |

The Cotabambas system hosts two principal styles of copper-gold-silver sulphide mineralization. In Cluster 1, the mineralized quartz monzonite porphyries (QMP) and dikes within igneous and volcanic rocks of the Andahuaylas-Yauri Batholith. In Cluster 2, the mineralized skarn, sills and breccias within Cretaceous calcareous sediments of the Ferrobamba formation, associated with QMP.

The geology at the Chaupec Target is formed by a 350 m thick sill of diorite over-trusting from east to west the limestones and skarn zones. Along this contact the QMP intrudes like narrow sills and dikes, that could be responsible for the Cu, Au, Ag mineralization into the skarn zones over a package of 460 m to 600 m thickness. The Geologic deformation occurs along 3.5 km where the three Zones were identified.

The spaced geophysics survey registered a possible and undiscovered QMP that could be located from 100 m to 200 m below the package of skarn, sills and dikes outcroppings in Zone 1 and Zone 2. This porphyry has a quartz monzonite composition and outcrops with Cu, Au, Ag mineralization in Zone 3, at the southern extreme of Chaupec. The low magnetic susceptibility, low resistivity and moderated chargeability typically constrain the potential extent of this porphyry.

About Panoro

Panoro Minerals is a uniquely positioned Peru focused copper exploration and development company. The Company is advancing its flagship project, Cotabambas Copper-Gold-Silver Project and its Antilla Copper-Molybdenum Project, both located in the strategically important area of southern Peru. The Company is well financed to expand, enhance and advance its projects in the region where infrastructure such as railway, roads, ports, water supply, power generation and transmission are readily available and expanding quickly. The region boasts the recent investment of over US$15 billion into the construction or expansion of four large open pit copper mines.

Since 2007, the Company has completed over 80,000 meters of exploration drilling at these two key projects leading to substantial increases in the mineral resource base for each, as summarized in the table below.

Summary of Cotabambas and Antilla Project Resources

| Project | Resource Classification | Million Tonnes | Cu (%) | Au (g/t) | Ag (g/t) | Mo (%) |

|---|---|---|---|---|---|---|

| Cotabambas Cu/Au/Ag | Indicated | 117.1 | 0.42 | 0.23 | 2.74 | 0.001 |

| Inferred | 605.3 | 0.31 | 0.17 | 2.33 | 0.002 | |

| @ 0.20% CuEq cutoff, effective October 2013, Tetratech | ||||||

| Antilla Cu/Mo | Indicated | 291.8 | 0.34 | - | - | 0.01 |

| Inferred | 90.5 | 0.26 | - | - | 0.007 | |

| @ 0.175% CuEq cutoff, effective May 2016, Tetratech | ||||||

Preliminary Economic Assessments (PEA) have been completed for both the Cotabambas and Antilla Projects, the key results are summarized below.

Summary of Cotabambas and Antilla Project PEA Results

| Key Project Parameters | Cotabambas Cu/Au/Ag Project1 | Antilla Cu Project2 | ||

|---|---|---|---|---|

| Process Feed, life of mine | million tonnes | 483.1 | 118.7 | |

| Process Feed, daily | Tonnes | 80,000 | 20,000 | |

| Strip Ratio, life of mine | 1.25 : 1 | 1.38: 1 | ||

| Before Tax1 | NPV7.5% | million USD | 1,053 | 520 |

| IRR | % | 20.4 | 34.7 | |

| Payback | years | 3.2 | 2.6 | |

| After Tax1 | NPV7.5% | million USD | 684 | 305 |

| IRR | % | 16.7 | 25.9 | |

| Payback | years | 3.6 | 3.0 | |

| Annual Average Payable Metals | Cu | thousand tonnes | 70.5 | 21.0 |

| Au | thousand ounces | 95.1 | - | |

| Ag | thousand ounces | 1,018.4 | - | |

| Mo | thousand tonnes | - | - | |

| Initial Capital Cost | million USD | 1,530 | 250 | |

| ||||

The PEAs are considered preliminary in nature and include Inferred Mineral Resources that are considered too speculative to have the economic considerations applied that would enable classification as Mineral Reserves. There is no certainty that the conclusions within the updated PEA will be realized. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

Luis Vela, a Qualified Person under National Instrument 43-101, has reviewed and approved the scientific and technical information in this press release.

On behalf of the Board of Panoro Minerals Ltd.

Luquman Shaheen. PEng, PE, MBA

President & CEO

FOR FURTHER INFORMATION, CONTACT:

| Panoro Minerals Ltd. Luquman Shaheen, President & CEO Phone: 604.684.4246 Fax: 604.684.4200 Email: info@panoro.com Web: www.panoro.com | Renmark Financial Communications Inc. Laura Welsh Tel.: (416) 644-2020 or (416) 939-3989 blwelsh@renmarkfinancial.com www.renmarkfinancial.com |

CAUTION REGARDING FORWARD LOOKING STATEMENTS: Information and statements contained in this news release that are not historical facts are “forward-looking information” within the meaning of applicable Canadian securities legislation and involve risks and uncertainties.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors which could cause actual events or results to differ materially from those expressed or implied by the forward-looking statements, including, without limitation:

- risks relating to metal price fluctuations;

- risks relating to estimates of mineral resources, production, capital and operating costs, decommissioning or reclamation expenses, proving to be inaccurate;

- the inherent operational risks associated with mining and mineral exploration, development, mine construction and operating activities, many of which are beyond Panoro’s control;

- risks relating to Panoro’s ability to enforce Panoro’s legal rights under permits or licenses or risk that Panoro’s will become subject to litigation or arbitration that has an adverse outcome;

- risks relating to Panoro’s projects being in Peru, including political, economic and regulatory instability;

- risks relating to the uncertainty of applications to obtain, extend or renew licenses and permits;

- risks relating to potential challenges to Panoro’s right to explore and/or develop its projects;

- risks relating to mineral resource estimates being based on interpretations and assumptions which may result in less mineral production under actual circumstances;

- risks relating to Panoro’s operations being subject to environmental and remediation requirements, which may increase the cost of doing business and restrict Panoro’s operations;

- risks relating to being adversely affected by environmental, safety and regulatory risks, including increased regulatory burdens or delays and changes of law;

- risks relating to inadequate insurance or inability to obtain insurance;

- risks relating to the fact that Panoro’s properties are not yet in commercial production;

- risks relating to fluctuations in foreign currency exchange rates, interest rates and tax rates; and

- risks relating to Panoro’s ability to raise funding to continue its exploration, development and mining activities.

This list is not exhaustive of the factors that may affect the forward-looking information and statements contained in this news release. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in the forward‑looking information. The forward‑looking information contained in this news release is based on beliefs, expectations and opinions as of the date of this news release. For the reasons set forth above, readers are cautioned not to place undue reliance on forward-looking information. Panoro does not undertake to update any forward-looking information and statements included herein, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.