Related Document

Vancouver, B.C., July 25, 2016 -- Panoro Minerals Ltd. (TSXV: PML, Lima: PML, Frankfurt: PZM) ("Panoro" or the "Company") is pleased to report the discovery of a new zone of skarn mineralization known as the Chaupec zone. Three main mineralized zones have been defined over an area of approximately 1 km by 3 km with strong copper values and located 3 to 4 km to the west of the current project resource limits as shown on the attached map.

Exploration work since 2013 has continued to outline a number of porphyry-style copper/gold mineralized zones outside of the main Ccalla-Azulccacca resource for which a Preliminary Economic Assessment was published in September 2015. Geological mapping, rock chip sampling and ground geophysical surveys on the property have identified a number of NE structural trends which appear to be important controls on the location of mineralization. The newly discovered Chaupec skarn mineralization is located at the intersection of one of these trends where it intersects with a major northerly structural trend extending 40 km north from the Las Bambas mine which has recently been put into production by MMG and will become one of Peru's largest new copper mines. The accompanying map shows the location of all known structural trends and mineralized zones located to date on the property.

Two clusters of mineralized zones are becoming evident. The first, Cluster 1, consists of at least six porphyry-style occurrences over a 4-km by 8-km area and includes the Ccalla and Azulccaca zones which together comprise the current resource base on the property. A second grouping over a 4-km by 12-km area to the southwest, Cluster 2, includes significant skarn-type mineralization in the Jean Louis, Ccayroyoc and newly defined Chaupec zones. Some porphyry-style copper mineralization is also present.

Other than at Ccalla and Azulccaca, these targets have not seen significant drilling as yet and represent excellent discovery potential. In 2016 and 2017 Panoro is planning a drilling campaign of 14,000 meters into the Cochapata and Maria Jose zones that may represent the northerly continuation of the Ccalla zone.

The Chaupec Target

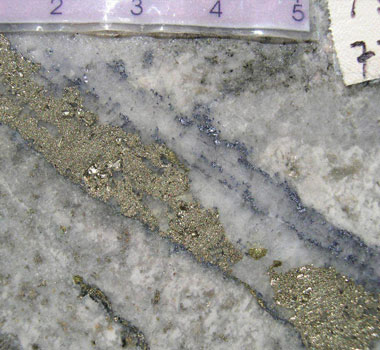

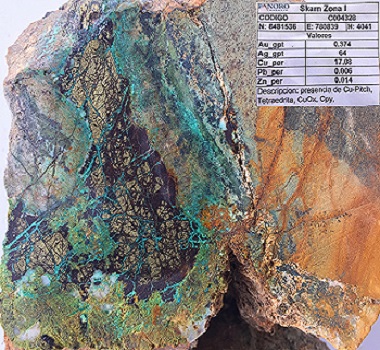

Mineralization at Chaupec consists of a polymetallic skarn developed at the contact between Cretaceous diorite and carbonate rocks of the Lower Tertiary Ferrobamba Formation. Work completed to date includes geological mapping at 1:1,000, 810 rock chip samples (1-2 sq metres each) on a 100 m by 100 m grid and geophysical surveys including 71.6 km of Induced Polarization, 63.7 km of magnetics and 45.1 km of Self Potential.

Of the three main mineralized zones defined at Chaupec, two consist of outcropping garnet skarns that have in part been retrograded to epidote and chlorite. Porphyry-style mineralization has also been observed in outcrop and there is some evidence that it may continue to the north under the limestone and colluvial cover. The skarn contains variable amounts of chalcopyrite, pyrite, bornite, chalcocite and copper oxides along with massive magnetite in places.

Values of copper and gold in the rock chip samples from these two zones range from 0.21% Cu to 8.15% Cu and 0.005 g/t Au to 2.69 g/t Au. Table 1 summarizes the extent of and average values found in the two anomalies. The complete sampling data set is summarized on the Company's website.

Table 1: Sampling results in the skarn mineralization.

| Anomaly | Grade Contour | # Samples | Area | Arithmetic Average Grade (*) | |||||

|---|---|---|---|---|---|---|---|---|---|

| Cu ppm | Length m | Width m | Cu % | Au g/t | Ag g/t | Pb ppm | Zn ppm | ||

| 1 | 2,000 | 40 | 1500 | 530 | 1.11 | 0.058 | 22.00 | 596 | 852 |

| Including | 5,000 | 20 | 940 | 170 | 1.55 | 0.064 | 25.50 | 612 | 923 |

| 2 | 2,000 | 19 | 950 | 470 | 1.11 | 0.305 | 6.30 | 49 | 183 |

| Including | 5,000 | 10 | 590 | 215 | 1.70 | 0.525 | 10.10 | 45 | 221 |

| (*) Grades capped at percentile 90. | |||||||||

The third prospect consists of outcropping quartz-monzonite porphyry with stockwork quartz veining that is situated at the contact between the diorite and limestone. The rock chip sampling program covered an area of 1 km by 1 km, where 18 samples contained copper and gold values ranging from 0.21% Cu to 1.52% Cu and 0.005 g/t Au to 0.255 g/t Au. Table 2 summarizes the areal extent of and average values found in this area. Table 2: Sampling results in the porphyry mineralization.

| Anomaly | Grade Contour | # Samples | Area | Arithmetic Average Grade (*) | |||||

|---|---|---|---|---|---|---|---|---|---|

| Cu ppm | Length m | Width m | Cu % | Au g/t | Ag g/t | Pb ppm | Zn ppm | ||

| 3 | 2,000 | 18 | 540 | 415 | 0.72 | 0.031 | 23.90 | 1726 | 133 |

| Including | 5,000 | 11 | 380 | 193 | 0.98 | 0.041 | 13.20 | 2542 | 133 |

| (*) Grades capped at percentile 90. | |||||||||

In general, the skarn mineralization in Chaupec has the highest grades found yet at the Cotabambas project. Skarn-type mineralization plays an important role in other major deposits in the region, including Las Bambas, Constancia, Antapaccay and Coroccohuayco, where higher grades in the skarn in the first years of mining can contribute to more rapid payback. For more information about Chaupec, see Panoro's website. Luquman Shaheen, President & CEO of Panoro states, "The discovery of Chaupec adds an important potential new addition to the Cotabambas Project. The scale of the footprint at Chaupec is more than twice the size of the footprint of the current resource. The grades at surface are also higher than as observed at surface in the area of the current resource. Additional work at Chaupec will be required to delineate and quantify the resource potential, but it looks to be significant and a potential project scale changer. The PEA identified a number of potential enhancements to the Cotabambas Project such as the addition of an SX/EW component, improvement of metallurgical recoveries and the addition of a high-grade resource from the Maria Jose target near to the proposed plant site. Panoro is currently in the planning stage and hopes that the successful completion of these planned activities will significantly increase the value of the Cotabambas Project. The Chaupec potential appears that it could add significant additional value to the Cotabambas project."

About Panoro

Panoro Minerals is a uniquely positioned Peru and Copper-focused exploration company. The Company is advancing a significant project portfolio in the key Andahuaylas-Yauri belt in south central Peru, including its advanced stage Cotabambas Copper-Gold-Silver-Molybdenum and Antilla Copper-Molybdenum Projects. Since 2007, the Company has completed over 70,000 m of exploration drilling at these two key projects leading to substantial increases in the mineral resource base for each, as summarized in the table below.

Summary of Cotabambas and Antilla Project Resources

| Project | Resource Classification | Million tonnes | Cu (%) | Au (g/t) | Ag (g/t) | Mo (%) |

| Cotabambas Cu/Au/Ag | Indicated | 117.1 | 0.42 | 0.23 | 2.74 | 0.001 |

| Inferred | 605.3 | 0.31 | 0.17 | 2.33 | 0.002 | |

| @ 0.20% CuEq cutoff, effective October 2013, Tetra Tech Inc. | ||||||

| Antilla Cu/Mo | Indicated | 291.8 | 0.34 | - | - | 0.01 |

| Inferred | 90.5 | 0.26 | - | - | 0.007 | |

| @ 0.175% CuEq cutoff, effective October 2015, Tetra Tech Inc. | ||||||

Preliminary Economic Assessments (PEA) have been completed for both the Cotabambas and Antilla Projects, by AMEC and Moose Mountain for Cotabambas and SRK and Moose Mountain for Antilla, the key results are summarized below.

Summary of Cotabambas and Antilla Project PEA Results

| Key Project Parameters | Cotabambas Cu/Au/Ag Project | Antilla Cu/Mo Project | ||

| Mill Feed, life of mine | million tonnes | 483.1 | 350.4 | |

| Mill Feed, daily | tonnes | 80,000 | 40,000 | |

| Strip Ratio, life of mine | 1.25 : 1 | 0.85 : 1 | ||

| Before Tax1 | NPV7.5% | million USD | 1,053 | 491 |

| IRR | % | 20.4 | 22.2 | |

| Payback | years | 3.2 | 3.3 | |

| After Tax1 | NPV7.5% | million USD | 684 | 225 |

| IRR | % | 16.7 | 15.1 | |

| Payback | years | 3.6 | 4.1 | |

| Annual Average Payable Metals | Cu | thousand tonnes | 70.5 | 36.8 |

| Au | thousand ounces | 95.1 | - | |

| Ag | thousand ounces | 1,018.4 | - | |

| Mo | thousand tonnes | - | 0.9 | |

| Initial Capital Cost | million USD | 1,530 | 603 | |

| 1Project economics estimated at commodity prices of; Cu = $US3.00/lb, Au = $US1,250/oz, Ag = $US18.50/oz, Mo = $US12/lb | ||||

The PEAs are considered preliminary in nature and include Inferred Mineral Resources that are considered too speculative to have the economic considerations applied that would enable classification as Mineral Reserves. There is no certainty that the conclusions within the PEAs will be realized. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

Luis Vela, a P.Geo Qualified Person under National Instrument 43-101, has reviewed and approved the scientific and technical information in this press release.

On behalf of the Board of Panoro Minerals Ltd.

Luquman A. Shaheen, M.B.A., P.Eng., P.E. President & CEO

FOR FURTHER INFORMATION, CONTACT:

Panoro Minerals Ltd.

Luquman A. Shaheen, President & CEO

Phone: 604.684.4246 Fax: 604.684.4200

Email: info@panoro.com

Web: www.panoro.com

Cautionary Note Regarding Forward-Looking Statements

This news release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable Canadian and US securities legislation. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding the Company's next shareholder meeting. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate and similar expressions, or are those, which, by their nature, refer to future events. The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results, performance, or actions and that actual results and actions may differ materially from those in forward-looking statements as a result of various factors, including, but not limited to, those risks and uncertainties disclosed in the Company's Management Discussion and Analysis and Annual Information Form for the year ended December 31, 2015 filed with certain securities commissions in Canada and other information released by the Company and filed with the appropriate regulatory agencies. All of the Company's Canadian public disclosure filings may be accessed via www.sedar.com and readers are urged to review these materials, including the technical reports filed with respect to the Company's mineral properties.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.