Related Document

Vancouver, B.C., April 9, 2015 -- Panoro Minerals Ltd. (TSXV: PML, Lima: PML, Frankfurt: PZM) ("Panoro", the "Company") is pleased to announce that it has received the results of an independent Preliminary Economic Assessment ("PEA") of the Company's 100% owned Cotabambas project in Peru. The Cotabambas project is a porphyry copper-gold-silver deposit, located 48 km south west of the city of Cuzco, in the Apurimac region in Southern Peru.

Highlights

- Pre-tax NPV(7.5%) is US$ 981.7 million, IRR is 17.3% and payback is estimated at 3.6 years

- After-tax NPV(7.5%) is US$ 627.5 million, IRR is 14.4% and payback is estimated at 4.0 years

- Conventional open pit mining and flotation processing at a design throughput of 80,000 tonnes per day with a mine life of 19 years

- Average annual payable copper of 143.4 million pounds

- Average annual payable gold of 88.0 thousand ounces

- Average annual payable silver of 967.2 thousand ounces

- Average direct cash costs (C1) of US$1.26 per pound of copper, net of by product credits

- Initial project capital costs of US$ 1.38 billion, including contingencies

- Good potential for discovery of additional mineralization.

The PEA was prepared by Amec Foster Wheeler Perú S.A. ("Amec Foster Wheeler") in accordance with the definitions in Canadian National Instrument 43-101. All dollar amounts are US currency. The PEA is considered preliminary in nature. It includes Inferred Mineral Resources that are considered too speculative to have the economic considerations applied that would enable classification as Mineral Reserves. There is no certainty that the conclusions within the PEA will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Tetra Tech completed the mineral resource estimate for the Cotabambas project utilizing all drill and assay results available to June 20, 2013 including 56,813 meters of drilling by Panoro and 9,923 meters of drilling from legacy campaigns. The mineral resource estimate includes hypogene and supergene sulphides and oxide copper and gold mineralization from the Ccalla and to a lesser extent the Azulccacca zones.

"Panoro is pleased with the results of the PEA which demonstrate that the Cotabambas Project should be advanced along the road to development", stated Luquman Shaheen, President and CEO of Panoro. "The principal technical areas of mining, processing, infrastructure and concentrate transport and marketing all demonstrate very achievable solutions for the construction of the next key copper project in one of the most active copper development regions of the world. The economics of the project look strong with a number of potential enhancements still to be achieved. The exploration potential at the Ccalla and Azulccaca deposits looks compelling with another eight targets still to be evaluated. Prior to October 2012, the Cotabambas project contained a small, inferred resource with less than 10,000 m of total exploration completed. Since then and through a very tough period in the exploration business, the project resource has grown significantly with investment into past drilling campaigns and now the PEA has demonstrated the potential positive economics for the project. The PEA provides a positive snapshot of the current technical and economic metrics of the project and identifies potential for growth and optimization ".

Economics

The table below summarizes base case economic metrics for the project as well as its sensitivity to the price of copper:

Table 1 Summary of PEA estimates of NPV and Payback

| After-Tax (million USD) | Pre-Tax (million USD) | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| Copper Price ($/lb) | NPV (5%) | NPV (7.5%) | NPV (10.0%) | Payback (Yrs) | NPV (5%) | NPV (7.5%) | NPV (10%) | Payback (Yrs) | |

| 3.00 | 755.0 | 416.1 | 167.9 | 4.6 | 1,124 | 697.1 | 386.1 | 4.2 | |

| 3.25 | 1,015 | 627.5 | 342.6 | 4.0 | 1,476 | 981.7 | 620.7 | 3.6 | |

| 3.50 | 1,276 | 838.0 | 517.3 | 3.6 | 1,827 | 1,266 | 855.1 | 3.1 | |

Note: base case at Cu=$US 3.25 in bold

Cash flows are assumed to occur at the beginning of each period

Project economics were estimated on the basis of long term consensus metal price forecasts derived from prices periodically published by a number of large banking and financial institutions and included copper at $3.25/lb, gold at $1300/oz and silver at $20.50/oz.

Mineral Resources

The PEA was completed based on the resource estimate of the Cotabambas Project prepared by Tetra Tech originally announced with an effective date of October 2013.

Full details of the Mineral Resource Estimate can be found in the Tetra Tech report filed on Sedar

Technical Report and Resource Estimate of the Cotabambas Copper-Gold Project, Peru. dated 7th July 2014.

Table 2: Mineral Resources, Tetra Tech, October 2013.

| Resources Category | Zone | Cut-Off | Million | Cu | Au | Ag | Mo | Cu | Au | Ag | Mo |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Grade% | Tonnes | (%) | (g/t) | (g/t) | (%) | (Blb) | (Moz) | (Moz) | (Mlb) | ||

| Cueq | |||||||||||

| Indicated | Hypogene Sulphide | 0.2 | 84.2 | 0.37 | 0.21 | 2.73 | 0.0018 | 0.69 | 0.58 | 7.39 | 3.43 |

| Supergene Sulphide | 0.2 | 8.9 | 0.73 | 0.31 | 3.07 | - | 0.14 | 0.09 | 0.88 | 0.01 | |

| Oxide Copper-Gold | 0.2 | 23.8 | 0.49 | 0.24 | 2.63 | - | 0.26 | 0.18 | 2.01 | 0.01 | |

| Oxide Gold | Na | 0.2 | - | 0.66 | 3.74 | - | - | 0 | 0.02 | - | |

| Total | 117.1 | 0.42 | 0.23 | 2.74 | 0.0013 | 1.09 | 0.86 | 10.3 | 3.45 | ||

| Inferred | Hypogene Sulphide | 0.2 | 521 | 0.29 | 0.18 | 2.41 | 0.0021 | 3.36 | 2.94 | 40.35 | 24.22 |

| Supergene Sulphide | 0.2 | 7.4 | 0.73 | 0.18 | 1.93 | 0.0007 | 0.12 | 0.04 | 0.46 | 0.11 | |

| Oxide Copper-Gold | 0.2 | 75.8 | 0.41 | 0.15 | 1.82 | 0.0003 | 0.68 | 0.37 | 4.44 | 0.5 | |

| Oxide Gold | Na | 1.2 | - | 0.61 | 3.27 | - | - | 0.02 | 0.12 | - | |

| Total | 0.2 | 605.3 | 0.31 | 0.17 | 2.33 | 0.0019 | 4.16 | 3.38 | 45.37 | 24.83 |

Mineral Resources have an effective date of June 20, 2013 and were estimated by Qualified Person Robert Morrison, P.Geo. (APGO, 1839). The estimate is based on 56,813 meters of drilling by Panoro and 9,923 meters of drilling from legacy campaigns. Copper equivalent (CuEq) is calculated using the equation: CuEq = Cu + 0.4422 Au + 0.0065*Ag, based on the differentials of long range metal prices net of selling costs and metallurgical recoveries for gold and copper and silver. Mineralization would be mined from open pit and treated using conventional flotation and hydrometallurgical flow sheets. Rounding in accordance with reporting guidelines may result in summation differences. CuEQ cut-offs were used to report almost all of the resource. These cut-offs are a function of metal price and recoveries. In the in situ resource, estimated gold, silver and molybdenum are then converted to US dollars and combined. The combined funds are re-converted to copper and added to the in situ copper values. The following metal prices are used: copper -- US$3.20/lb; gold -- $US$1,350/troy oz; silver -- $US$23.00/troy oz; molybdenum -- US$12.50/lb. The following metal recoveries were applied to the in situ resource: molybdenum -- 40%; gold -- 64%; silver -- 63%. As the resource is reported as in situ, no recovery is applied to copper.

Subsequent to the issue of this Resource, a reclassification of oxide material for leach amenability according to an Amec Foster Wheeler study was undertaken by Tetra Tech. Inside the Oxide Copper-Gold Zone were identified sub-zones of Mixed, Oxides Copper and Oxide Copper-Gold using information of the drill cores sequential copper assays results. The Model was regularized to facilitate mining studies and extra fields were calculated to report the Resources with new categories on this specific zone, to better inform future mining studies.

The Oxide mineralization can be reported in greater detail, based on studies completed by Amec Foster Wheeler utilising Cyanide leach grade Variable, Flotation recovery grade Variable, and Acid leach recovery Variables.

The Oxide material can be subdivided as per the tables below. Work was completed in April 2015.

Table 3: Mineral Resource in Indicated Category Classified by Mineralization Type.

| Zone | Subzone | Cutoff Grade (% Cueq) | Million Tonnes | Cu (%) | Au (g/t) | Ag (g/t) | Mo (%) |

|---|---|---|---|---|---|---|---|

| Hypogene Sulphide | 0.20 | 84.2 | 0.37 | 0.21 | 2.73 | 0.0018 | |

| Supergene Sulphide | 0.20 | 8.9 | 0.73 | 0.31 | 3.07 | - | |

| Oxide Copper-Gold | Oxides Copper | 0.20 | 5.8 | 0.61 | 0.12 | 2.16 | 0.0001 |

| Mixed | 0.20 | 14.1 | 0.38 | 0.24 | 2.63 | - | |

| Oxide Copper-Gold | 0.20 | 3.9 | 0.70 | 0.41 | 3.38 | - | |

| Oxide Gold | n/a | 0.22 | 0.64 | 3.80 | - | ||

| Total | 0.20 | 117.1 | 0.42 | 0.23 | 2.74 | 0.0013 |

Table 4: Mineral Resource in Inferred Category Classified by Mineralization Type.

| Zone | Subzone | Cutoff Grade (% Cueq) | Million Tonnes | Cu (%) | Au (g/t) | Ag (g/t) | Mo (%) |

|---|---|---|---|---|---|---|---|

| Hypogene Sulphide | 0.20 | 521.0 | 0.29 | 0.18 | 2.41 | 0.0021 | |

| Supergene Sulphide | 0.20 | 7.4 | 0.73 | 0.18 | 1.93 | 0.0007 | |

| Oxide Copper-Gold | Oxides Copper | 0.20 | 25.8 | 0.51 | 0.10 | 1.47 | 0.005 |

| Mixed | 0.20 | 44.6 | 0.35 | 0.16 | 1.92 | 0.0002 | |

| Oxide Copper-Gold | 0.20 | 3.5 | 0.64 | 0.42 | 2.78 | 0.0001 | |

| Oxide Gold | n/a | 1.2 | - | 0.61 | 3.27 | - | |

| Total | 0.20 | 603.5 | 0.31 | 0.18 | 2.33 | 0.0019 |

Recoding the oxide zone does not constitute a material change to the published Resource. Minor variability in tables is due to the regularisation process. Totals may not sum due to rounding. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

The NI 43-101 resource estimate and PEA include the results from the drilling to date at the Ccalla and Azulccaca deposits. Good potential has been identified for the discovery of additional mineralization that may support resource estimation.

Mining and Processing

The PEA contemplates an 80,000 tonne per day plant throughput rate with mill feed coming from two open pits, Ccalla and Azulccaca. Mineralized material will be mined first from the larger Ccalla open pit and then from the Azulccaca pit as the Ccalla pit is depleted. Mining will be by conventional truck and shovel removal of mill feed to the processing plant that will be located 0.5 km to the north side of the Ccalla pit limits. The life of mine waste/mill feed strip ratio is 1.03. Waste rock will be placed in a storage area in Guaclle creek adjacent to the north side of the Ccalla pit. A fraction of the waste will hauled via surface and in-pit haul roads and the balance will be crushed and delivered to the waste rock area by conveyor through a 1.0 km tunnel.

The run of mine mineralized material will feed one primary gyratory crusher and then fed to a SAG Mill and two ball mills, with classification by hydrocyclones. The flotation circuit will consist of a rougher flotation stage, regrinding, a primary cleaning stage followed by a cleaner-scavenger stage and two stages of re-cleaning using conventional flotation cells.

The flotation tailings will be thickened to 62% solids and pumped to the Tailing Storage Facility by positive displacement pumps. The final flotation concentrate will contain copper, gold and silver, free of deleterious elements. After thickening and filtering, the concentrate will be transported by truck to the Matarani seaport in Arequipa, along existing road networks.

The treatment of oxide copper subzone is not included in the PEA. Metallurgical testing to date has shown that copper recoveries from this material in the flotation circuit are low and insufficient tonnes have been outlined to date to warrant a separate heap leach and SX/EW circuit. However, there is some potential to expand the extent of known existing oxide copper mineralization with more drilling, and the addition of such a circuit remains a future opportunity.

Metallurgical studies have estimated recoveries from the mill feed material as shown in the table below.

Table 5 Summary of Metallurgical Recoveries Estimated in the PEA

| Ore Type | Subzone | Cu Recovery (%) | Au Recovery (%) | Ag Recovery (%) | Mo Recovery (%) |

|---|---|---|---|---|---|

| Hypogene Sulphide | 87.5 | 62.0 | 60.4 | - | |

| Supergene Sulphide | 87.5 | 62.0 | 60.4 | - | |

| Oxide Copper-Gold | Oxides Copper | - | - | - | - |

| Mixed | 60.0 | 55.0 | - | ||

| Oxide Copper-Gold | - | 65.0 | - | - | |

| Oxide Gold | - | - | - | - |

Metallurgical testwork in 2014 was carried out at Certimin Laboratories in Lima, Peru in a program designed and supervised by Amec Foster Wheeler personnel. Constant metallurgical recoveries were estimated over the life of mine. The current mine plan includes mining of higher grade zones in the early life of mine where higher recoveries may be demonstrated with further test work. No recovery of molybdenum has been included in the current estimate. Metallurgical testwork in 2014 demonstrated the potential for molybdenum recovery, however it was not included in the PEA mine plan. The inclusion of molybdenum recovery will be investigated in subsequent studies.

Projected production of payable metals is summarized in the table below:

Table 6 Summary of Annual Average and Life of Mine Payable Metals

| Annual Average | Life of Mine | |

| Copper (Mlbs) | 143.4 | 2,725 |

| Gold (koz) | 88.0 | 1,671 |

| Silver (koz) | 967.2 | 18,377 |

Capital and Operating Costs

The projected capital and operating costs for Cotabambas over a 19-year mine life are summarized in the tables below.

Table 7 Summary of Cotabambas Initial Capital Cost Estimates (US$ millions)

| Mine Equipment | 194.8 |

| Mine Development | 66.0 |

| Mine Infrastructure | 15.6 |

| Tailings Starter Dams | 4.4 |

| Tailings Disposal System | 73.7 |

| Process Plant | 555.6 |

| Site Infrastructure | 25.6 |

| Offsite Infrastructure | 18.6 |

| Subtotal | 954.4 |

| Owners Cost | 40.0 |

| Indirect Costs | 153.1 |

| Subtotal | 1,147.4 |

| Contingencies | 232.3 |

| Initial Capital Cost | 1,379.7 |

Power will be supplied from via a 60 km power line connected to the national grid at the new Abancay substation at the town of Abancay to the northwest of the Cotabambas project. Concentrate will be trucked by contractor from the mine site to the port of Matarani, in Arequipa, along existing road networks.

Table 8 Cotabambas Sustaining Capital Costs (US$ millions)

| Mine Equipment | 201.0 |

| Tailings | 500.2 |

| Total Sustaining Capital Cost | 701.2 |

Table 9 Cotabambas Operating Costs (US$ per tonne milled)

| Mining Cost | 3.33 |

| Processing Cost | 4.47 |

| G&A Costs | 0.41 |

| Total Operating Cost | 8.22 |

1 and C2 cash costs (as defined by Brook Hunt) per pound of payable copper are listed in the table below.

Table 10 Cotabambas Average Cash Costs (US$) per Lb Payable Copper

| C1 - Direct Cash Cost | 1.26 |

| C2 - Production Cost | 2.02 |

Mineral Resource Sub-set within the PEA Mine Plan

The subset of the Mineral Resources contained within the Azulccaca and Ccalla pits that is included in the PEA mine plan is 136.7 Mt averaging 0.35%Cu, 0.20 Au g/t, 2.5 Ag g/t classified as Indicated Mineral Resources, and 397.1 Mt averaging 0.28%Cu, 0.16 Au g/t, 2.21 Ag g/t classified as Inferred Mineral Resources. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. The mine plan supports a mine life of 19 years. The pit slope angle is 42 degrees OSA and strip ratio of waste/mill of 1.03. More details will be presented in the PEA Technical Report.

Opportunities for Project Growth and Enhanced Economics

- Copper-Gold Oxide material that will be stockpiled for future opportunity

- Good potential to expand the known mineralization extent at the Ccalla and Azulccaca deposits with additional drilling along strike

- A gravity circuit inside the flotation flowsheet will be investigated with additional metallurgical testing to investigate the production of doré

- Potential to increase higher grade mill feed processed in the early mine life with additional studies to optimize the mine plan

- Potential to increase recoveries with additional metallurgical testing and to improve discrimination between metallurgical types within the deposit

- Higher grades of molybdenum have been intersected below and lateral to the current PEA pit limits and with continued exploration success, there is potential to add molybdenum as a third byproduct to the operation

- As detailed in a June 23, 2014 news release, eight other mineralized prospects have been identified in the general vicinity of the known deposits and represent Project upside potential to add to the known Mineral Resources with additional drilling and technical studies.

Future Work

Further work leading to a Pre-Feasibility Study is recommended and will include drilling, engineering and marketing studies, hydrological and geotechnical analysis, as well as various baseline environmental and archeological studies. In addition, exploration work will be conducted over the other targets in the vicinity of the known deposits.

The complete technical report constituting the PEA will be filed within 45 days and will be available on Panoro's website and on SEDAR. The technical report will be authored by the following Qualified Persons:

Information in this news release which is derived from the PEA has been reviewed by the Qualified Persons of Tetra Tech and Amec Foster Wheeler.

| Qualified Person | Firm |

| William Colquhoun | AMEC Foster Wheeler |

| Sergio Muñoz | AMEC Foster Wheeler |

| Khera Vikram | AMEC Foster Wheeler |

| Stewart Twigg | AMEC Foster Wheeler |

| Robert Morrison | Tetra Tech |

About Panoro

Panoro is advancing its significant portfolio of copper and gold projects in the key Andahuaylas-Yauri belt in south central Peru, including its advanced stage Cotabambas Copper-Gold-Silver-Molybdenum and Antilla Copper-Molybdenum Projects.

Since 2007, the company has completed over 70,000 m of exploration drilling at these two key projects leading to the delineation of mineral resources in late 2013 of:

| Cotabambas: | Indicated Resource 117.1 Mt @ 0.42% Cu, 0.23g/t Au, 2.74 g/t Ag & 0.001%Mo (@0.2% Cueq cutoff) Inferred Resource 603.5 Mt @ 0.31% Cu, 0.17g/t Au, 2.33 g/t Ag and 0.002 %Mo (@0.2% Cueq cutoff) (Tetra Tech, with an effective date of October 2013) | |

| Antilla: | Indicated Resource 188.5 Mt @ 0.40% Cu and 0.009% Mo (@0.2% Cueq cutoff) Inferred Resource 145.9 Mt @ 0.28% Cu and 0.009%Mo (@0.2% Cueq cutoff) (Tetra Tech, with an effective date of December 2013) |

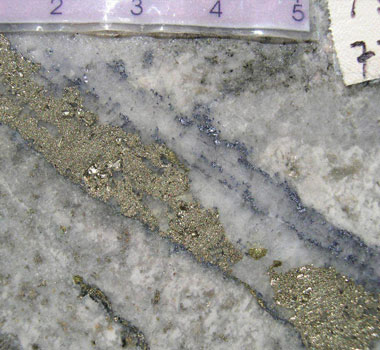

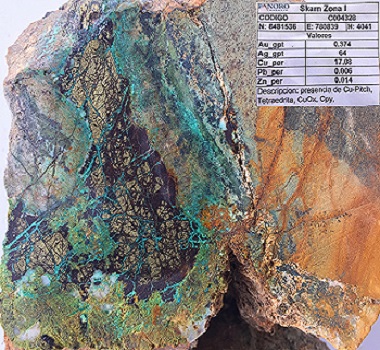

To date exploration at the Cotabambas Project has focused on the Ccalla and Azulccaca deposits. However, at least eight other porphyry and skarn target zones have been identified within the company's Cotabambas mineral concession blocks. Drilling at these targets is planned.

The Antilla is of smaller scale than the Cotabambas project. The PEA for the Antilla Project is in process with completion expected soon.

In addition to the Cotabambas and Antilla Projects, Panoro's portfolio includes more than 10 earlier stage projects in primarily the same region of south central Peru. Peru's national objective of doubling copper production together with the development of the many copper projects in the region, together with the private and public investments into rail, road, power generation and transmission and port infrastructure are leading to the rapid growth of an important global center for copper production. Panoro's large portfolio is situated here along with the Las Bambas, Tintaya, Antapaccay, Haquira, Constancia, Las Chancas and Trapiche projects all of which are either in exploration stage, construction or already in production.

Luis Vela, a P. Geo Qualified Person under National Instrument 43-101, has reviewed and approved the scientific and technical information in this press release.

On behalf of the Board of Panoro Minerals Ltd.

Luquman A. Shaheen, M.B.A., P.Eng., P.E. President & CEO

FOR FURTHER INFORMATION, CONTACT:

| Panoro Minerals Ltd. Luquman A. Shaheen, President & CEO Phone: 604.684.4246 Fax: 604.684.4200 Email: info@panoro.com Web: www.panoro.com | Renmark Financial Communications Inc. Barbara Komorowski: bkomorowski@renmarkfinancial.com Tel.: (514) 939-3989 or (416) 644-2020 www.renmarkfinancial.com |

This release was prepared by management of the Company who takes full responsibility for its contents. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.