Vancouver, B.C., March 15, 2007 - Panoro Minerals Ltd., TSX-V: PML; Frankfurt: WKN914959, (the "Company") is pleased to announce that an independent report by SRK Consulting detailing the Company's recent Peruvian acquisition has been received and is now available for public viewing on SEDAR and the Company's website.

On March 2, the Company signed a binding Purchase and Sale Agreement to acquire all of the outstanding shares of Cordillera de las Minas S.A. (CDLM), a Peruvian corporation from CVRD International S.A. and a wholly owned subsidiary of Antafagasta PLC of Chile. CDLM owns a 100% interest in a 43,792 hectare portfolio of 13 properties located in the Andahuaylas -- Yauri copper-gold belt south of Cuzco, Peru. Originally known for its skarn copper mineralization, at least 31 porphyry-style copper prospects have been discovered in this belt in recent years, including Xstrata's Las Bambas project with reported resources of 300 million tonnes at a grade of 1.1% copper and Grupo Mexico's Las Chancas project with reported resources of 200 million tonnes at a grade of 1% copper.

Two of the projects in the CDLM portfolio, Cotabambas and Antilla, are at an advanced stage of exploration and are defined by high quality databases. Cotabambas is a cluster of copper-gold porphyry systems within which SRK has estimated an Inferred Mineral Resource of 90 million tonnes at a grade of 0.77% copper and 0.42 grams of gold per tonne at a cut-off grade of 0.4% copper. SRK considers the potential to upgrade and to expand this Resource to be excellent.

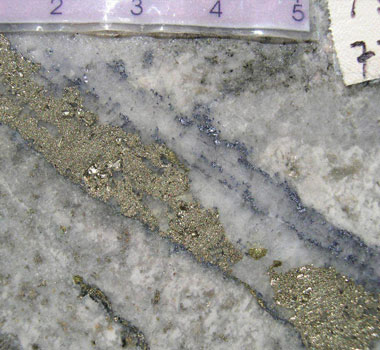

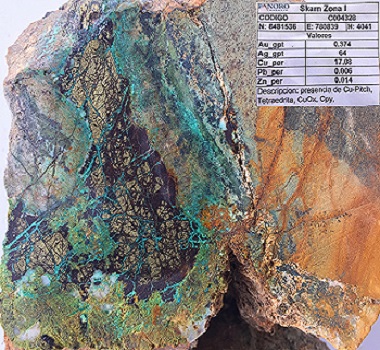

The second advanced project, Antilla, consists of a zone of secondary sulphide (chalcocite-covellite) enrichment related to underlying porphyry-style copper mineralization and alteration that remains largely unknown. SRK is of the opinion that the Antilla deposit is an excellent Exploration Target with potential in the range of 135 million tonnes at grades ranging from 0.61% to 0.75% copper. SRK considers the potential to confirm and expand this Target also to be excellent and that the possibility of an underlying porphyry system represents a compelling target for further exploration.

The reader is cautioned that the potential quantity and grade of Exploration Targets as described in this release is conceptual in nature, that there has been insufficient exploration to define a mineral resource and that it is uncertain if further exploration will result in the target being delineated as a mineral resource.

The CDLM portfolio includes 11 additional projects at varying stages of exploration, including the Alicia copper skarn prospect as well as the Promesa, Pistoro Norte, Morosayhuas and Kusiorcco porphyry copper prospects. Also of particular interest are the Cochasayhuas project, where the historical San Fernando mine produced 401,000 ounces of gold and 480,000 ounces of silver from a system of quartz veins and Sancapampa, where a 1 x 3 kilometre silica cap may represent the top of an epithermal precious metals system. In addition to these and other prospects, the acquisition includes a large database of regional geochemical and airborne geophysical data, much of which remains to be evaluated.

SRK has recommended a US$11 million budget for work on the project portfolio, including systematic drilling programs to confirm, define and expand the resources and mineralized zones at Cotabambas (20,000m) and Antilla (15,000m) respectively. Drilling is also recommended for the Kusiorcco (1,200m), Pistoro Norte (1,200m) and Morosayhuas (900m) projects. Further field and data evaluations, including geophysical surveys, are recommended for the remaining prospects. Finally, the budget provides for initial metallurgical studies at Antilla and Cotabambas, environmental and hydrological baseline studies as well as a sizeable allowance for community relations programs.

The Company is very pleased with the SRK report. It confirms the Company's belief that both of the principal projects in the acquisition, Cotabambas and Antilla, have excellent potential for rapid progress to pre- and full feasibility studies and that the remainder of the portfolio represents a high quality pipeline of earlier stage projects, any of which has the potential to advance to the next stage of exploration.

For more detailed preliminary information on individual properties of the CDLM acquisition and for the terms of the acquisition the reader is referred to the Company's news release of March 5, 2007.

With the divestiture of the Company's interest in the Surigao Joint Venture in the Philippines, announced on March 14, 2007, the Company will be able to focus its entire effort on Peru and on the excellent opportunities for the growth of the Company that are represented by the depth and quality of this portfolio.

On behalf of the Board of Panoro Minerals Ltd.

Helmut H. Wober, P.Eng.,

President and Director

ABOUT PANORO

Panoro Minerals Ltd. is a Canadian mineral exploration company trading on the TSX Venture Exchange (PML) and on the Frankfurt Stock Exchange (PZM, WKN 914959). For investor inquiries, please call 604-684 4246, send an e-mail to info@panoro.com or visit the company's website at www.panoro.com.

This release was prepared by management of the Company who takes full responsibility for its contents. The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this news release.