NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR DISSEMINATION IN THE U.S.A.

Vancouver, B.C., May 30, 2007 -- Panoro Minerals Ltd. ("Panoro") is pleased to announce that subsequent to its May 25, 2007 press release, it has closed the final tranche of its private placement of subscription receipts. The company closed on an additional C$875,659 for total gross proceeds of C$20,170,119. The transaction was led by Research Capital Corporation and included Canaccord Capital Corporation (the "Agents"). Proceeds from the Subscription Receipts will be held in escrow until closing of the acquisition of Cordillera de las Minas S.A. ("CDLM"), which is expected to take place during the week of June 4.

Each subscription receipt, priced at $0.60 per subscription receipt will be automatically exchanged for one unit (a "Unit") of Panoro immediately prior to the closing of the Company's acquisition of CDLM. Each Unit will consist of one common share (a "Common Share") of Panoro and one-half of a common share purchase warrant (a "Warrant") with each full Warrant entitling the holder thereof to acquire one additional Common Share of Panoro at the exercise price of $0.75 for a period of 24 months following closing of the closing of the financing. In the event that the acquisition of CDLM does not occur within 120 days following closing of the private placement, the Subscription Receipts will be cancelled and holders thereof will be refunded their purchase price. The Subscription Receipts and the Units will be subject to a statutory hold period of four months from the date of closing.

For consideration for their services, the Agents received a cash commission equal to 7% of the gross proceeds of the offering and broker warrants entitling them to purchase 10% of the number of Subscription Receipts sold.

CDLM ACQUISITION

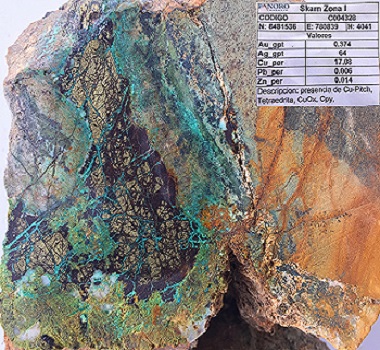

CDLM is the 100% owner of a portfolio of 13 properties, including the advanced stage Cotabambas and Antilla projects, all of which are located in the Andahuaylas -- Yauri Belt of Peru south of Cuzco where a number of recently discovered significant porphyry copper and copper-gold deposits are in various stages of advanced exploration or pre-development. The entire portfolio consists of 63 individual licenses covering a total area of 43,792 hectares.

On March 2, 2007, Panoro signed a binding Purchase and Sale Agreement to acquire all of the outstanding shares of Cordillera de las Minas S.A. a Peruvian corporation from CVRD International S.A. and El Tesoro (SPV Bermuda) Limited, a wholly owned subsidiary of Antofagasta PLC. On signing the Purchase and Sale Agreement, Panoro has made a non-refundable down payment of US$ 500,000. On closing, the Company will pay the vendors US$ 12,500,000 and 6 Million common shares of Panoro Minerals Ltd. Closing was originally agreed to be no later than ninety days after signing of the Purchase and Sale Agreement, on or before June 2, 2007, subject to financing and regulatory approval. An extension of this dead line has been mutually agreed upon and closing of the CDLM acquisition is expected to take place during the week of June 4.

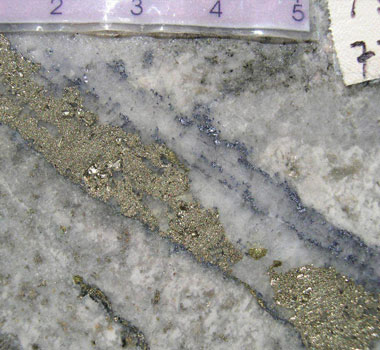

The successful completion of the private placement financing places Panoro into a firm position to complete the acquisition of CDLM and to embark on significant drilling programs on the core projects of the CDLM portfolio. Subject to permitting and the availability of drill rigs from reputable contractors, priority will be given to the Antilla project. The Antilla project features a geological potential of in the order of 135 million tonnes of secondarily enriched sulphide mineralization defined by seven drill holes with a grade in the range between 0.63 % and 0.79% copper, located near surface with a potentially very low waste to ore ratio. This qualifies the Antilla project as the candidate with the shortest time line towards a pre -- feasibility study and subsequent pre-development work leading to the requisite steps towards production.

The funds raised will also enable the Company to evaluate the other projects in the CDLM -- portfolio, including several drill holes at Cotabambas, and to determine the approaches to their respective project advancements. The Company and its acquisition of CDLM have received widespread attention and interest in the Peruvian mining industry.

The Company is extremely pleased with having arrived at this stage in its history and is looking forward to a very active exploration and pre-development period in the months and years ahead.

On behalf of the Board of

Panoro Minerals Ltd.

Helmut H. Wober, P.Eng.,

President and Director

ABOUT PANORO

Panoro Minerals Ltd. is a Canadian mineral exploration company trading on the TSX Venture Exchange (PML) and on the Frankfurt Stock Exchange (PZM). Panoro's strategic focus is on exploring for large-potential gold and copper/gold deposits in countries with the corresponding geological potential and where the right political and economic conditions are present.

For investor inquiries please call 604-684 4246, or send an e-mail to info@panoro.com or visit the company's website at www.panoro.com.

This release was prepared by management of the Company who takes full responsibility for its contents. The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this news release.