Vancouver, B.C., March 5, 2007 - Panoro Minerals Ltd. (the "Company") is pleased to announce that on March 2, 2007 it has signed a binding Purchase and Sale Agreement to acquire all of the outstanding shares of Cordillera de las Minas S.A. (CDLM), a Peruvian corporation from CVRD International S.A. and El Tesoro (SPV Bermuda) Limited, a wholly owned subsidiary of Antafagasta PLC.

CDLM is the 100% owner of a portfolio of 13 properties, including the advanced stage Cotabambas and Antilla projects, all of which are located in the Andahuaylas -- Yauri Belt of Peru south of Cuzco where a number of recently discovered significant porphyry copper and copper-gold deposits are in various stages of advanced exploration or pre-development. The entire portfolio consists of 63 individual licences covering a total area of 43,792 hectares.

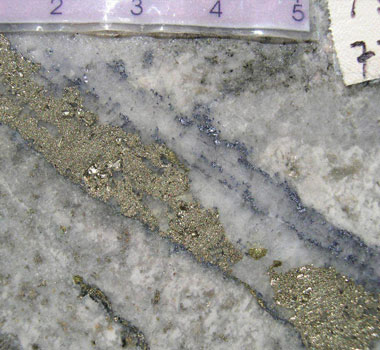

Cotabambas (9,900 hectares) is an advanced exploration project on a cluster of copper gold porphyry systems. A total of 11,770 metres of diamond drilling in 33 holes have been have been carried out on the project to date. SRK Consulting has estimated an Inferred Mineral Resource of 90 million tonnes at a grade of 0.77% copper and 0.42 grams of gold per tonne, at a cut-off grade of 0.4% copper. The potential to upgrade and to expand this estimate is considered to be excellent. The Cotabambas project is located about 38 kilometers due north of Xstrata's Las Bambas project with reported resources of 300 million tonnes with a grade of 1.1% copper.

Antilla (6,600 hectares) the second principal project, is also in an advanced exploration stage. The identified mineralization consists of a zone of secondary enrichment of porphyry style copper mineralization and alteration (consisting of secondary biotite) in a package of quartzites and arenites that has been intruded by a system of this type. The mineralization consists of predominantly sulphides (chalcocite, chalcopyrite and pyrite) associated with quartz stock-works, veinlets and disseminations. The project has to date been explored by 4,012 metres of diamond drilling in 19 holes of which 8 holes lie within the projected zone of mineralization. SRK Consulting is of the opinion that the Antilla deposit is an excellent Exploration Target with potential in the range of 135 million tonnes, at grades ranging from 0.61% to 0.75% copper. The potential to confirm and expand this target is also considered to be excellent. The Antilla project is located approximately 25 kilometers southeast of Grupo Mexico's Las Chancas project with reported resources of 200 million tonnes with a grade of 1% copper.

The reader is cautioned that the potential quantity and grade of Exploration Targets as described in this release is conceptual in nature, that there has been insufficient exploration to define a mineral resource and that it is uncertain if further exploration will result in the target being delineated as a mineral resource.

Both principal projects have received extensive prior work in the form of stream sediment-, rock- and soil geochemical surveys, ground magnetometer and Induced polarization surveys.

Other mineral deposits that have been reported from the Andahuaylas -Yauri Belt are the Constancia/San Jose project of Norsemont with an Indicated Resource of 58 million tonnes of 0.589% copper and 0.015% molybdenum and an Inferred resource of 104 million tonnes of 0.53% copper and 0.014% molybdenum as well as the Haquira project of Antares with an Inferred Resource of 129 million tonnes with a grade of 0.49% copper (amenable to SX/EW treatment) and 89.2 million tonnes with a grade of 0.42% copper in primary sulphides.

Further Highlights and Properties Included in the Acquisition:

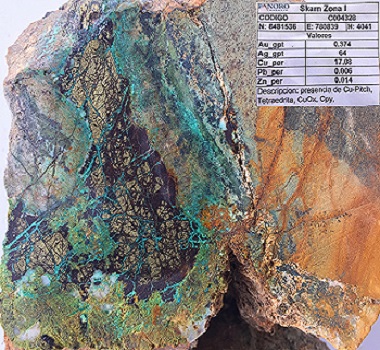

a) Alicia (2,594 hectares) consists of porphyry and skarn-style mineralization which, on the basis of 240 rock channel samples in surface trenches and projection to an average depth of 80 metres, is considered to be an Exploration Target of 4.5 million tonnes with grades in the range of 2.0-2.4% copper along with elevated values of gold, silver and molybdenum.

b) Promesa (3,000 hectares) the south-western-most prospect 35 kilometers southwest of Alicia, has received 4 diamond drill holes totalling 1,540 meters, with porphyry style mineralization encountered in each hole over several meters to 62 meters of 0.43% copper. Further work will be required on this prospect as well.

c) The Kusiorcco (3,862 hectares) property and target area lies at the same periphery of a circular feature visible on satellite imagery that also contains the Katanga Mine and Norsemont's Constancia project and includes a number of porphyry and skarn targets for drilling based on geophysical and geological surveys. The concessions of the Kusiorcco property are intertwined with concessions of Compañia Minera Maria Reyna, with Mitsui concessions adjoining to the south and Rio Tinto concessions to the west.

d) Pistoro Norte (2,100 hectares) contains larger geophysical drill targets at depth below porphyry style alteration and mineralization at surface.

e) Morosayhuas (800 hectares), closest to Cuzco, while showing a modest size area of porphyry style mineralization and alteration on surface, holds potentially much larger geophysical targets at depth.

f) Cohasayhuas (1,800 hectares), located close to the Haquira project of Antares has seen historical gold production from vein type mineralization in the years of 1912 to 1952, reportedly totalling 401,000 ounces of gold and 480,000 ounces of silver.

g) Sancapampa (1,200 hectares) 40 kilometers west of Cotabambas contains a 1 kilometer by 3 kilometer silica cap which may represent the top of an epithermal system. The target was discovered by stream sediment sampling and follow up prospecting.

The property portfolio comes with a large database of regional geochemical and airborne geophysical data that can be utilized to develop additional prospects.

An independent technical report on the portfolio has been prepared by SRK under the guidelines of National Instrument 43-101 and is in final draft form. It contains detailed evaluations of the Cotabambas and Antilla deposits and a preliminary evaluation of the other properties in the portfolio. The report will be available to the regulators and the public before closing of the transaction and investors are encouraged to refer to the report when it becomes available. Preliminary findings have given the Company the confidence to enter into this Purchase and Sale Agreement.

Helmut Wober, P. Eng., the Company's Qualified Person, has reviewed the technical information regarding the property portfolio described in this news release.

Standard Bank PLC acted as financial advisor to the vendors in connection with this transaction.

Terms of the Acquisition:

On signing the Purchase and Sale Agreement, Panoro has made a non-refundable down payment of US$ 500,000. On closing, the Company will pay the vendors US$ 12,500,000 and 6 Million common shares of Panoro Minerals Ltd. Closing will be no later than ninety days after signing of the Purchase and Sale Agreement, on or before June 2, 2007, and is subject to financing and regulatory approval.

The Company has formally engaged a leading Canadian Investment Banking house to be the Lead Manager of the financing. The funds raised will be used for this acquisition and a comprehensive program of confirmation and expansion drilling at Cotabambas and Antilla, exploration drill programs on Kusiorcco, Pistoro Norte and Morosayhuas as well as further detailed exploration programs on the remainder of the portfolio. The terms of the financing will be announced in the near future.

This acquisition will be a milestone in the life of the Company. The Company will focus its efforts on these assets and on Peru, where the Company has been active since 1996. The acquisition and subsequent work programs are designed to lead at least one or both of the principal projects Cotabambas and Antilla to initial economic evaluations and subsequently to pre - and full feasibility studies and production. The remainder of the portfolio is believed to contain the potential of other projects soon entering a similar progression.

The Company will also redirect its attention at its other project in Peru, the El Rosal -- La Ramada project. Further announcements regarding the El Rosal Project will follow in the near future.

On behalf of the Board of

Panoro Minerals Ltd.

Helmut H. Wober, P.Eng.,

President and Director

ABOUT PANORO

Panoro Minerals Ltd. is a Canadian mineral exploration company trading on the TSX Venture Exchange (PML) and on the Frankfurt Stock Exchange (PZM). Panoro's strategic focus is on exploring for large-potential gold and copper/gold deposits in countries with the corresponding geological potential and where the right political and economic conditions are present.

For investor inquiries please call 604-684 4246, or send an e-mail to info@panoro.com or visit the company's website at www.panoro.com.

This release was prepared by management of the Company who takes full responsibility for its contents. The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this news release.